How to Find Owners of Properties

in Ohio

Identifying the owner of individually and jointly owned properties in Ohio involves reviewing the records available at the county recorder's office. However, business and legal entities often hide the identity of property owners, meaning the process of finding out the owner can be more complicated. It may involve additional research, such as scouring business filings and hiring the services of title companies and legal professionals.

Identifying Ohio Property Owners

There is a recent surge in investor ownership in Ohio, with one out of six homes in the state being corporation-owned by institutional investors, according to 2022 records. In the county recorder's office, the recorded owner of a property may only be listed as an LLC or holding company, and you would need to dig deeper by contacting the Ohio Secretary of State's Office, among other means.

Even for properties owned by individuals, where contacting the county recorder's office should be helpful, the sheer volume of the data can be overwhelming. As such, there is a need for third-party commercial service providers, as discussed below:

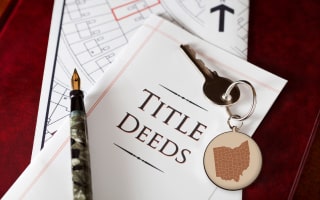

Check the Registry of Deeds

A registry of deeds is a database of all recorded real estate documents establishing property ownership. It's a single location where you can find information about mortgages, property tax, real estate contracts, liens, encumbrances, etc., of all properties in a county.

Each county in Ohio maintains its own registry of deeds, which can be accessed by visiting the county recorder's office. You can search a property by address, parcel number, or owner's name. You will have to pay a recorder fee that will depend on the service as outlined by the Ohio Revised Code.

Several counties in Ohio provide online access to their registry of deeds, including the following:

Assess Land Records

Land records are generated when a property transaction occurs. This can be a sale, transfer of ownership, mortgage, lease, easement, lien, etc. Each county maintains its own database of land records, usually maintained by the county recorder's office.

The process of assessing land records is the same as that of the registry of deeds. You will need to provide one or more of the following depending on the county's search criteria:

- Name of the property owner

- Property address

- Parcel number

Contact the City or Town Assessor's Office

An assessor determines the value of a property for taxation purposes. To carry out this responsibility, the office of the assessor must collect and maintain various records, including:

- Property assessment records, such as building details, lot size, and square footage, which help determine a property's value

- Ownership records

- Tax assessment records

- Property maps and plats

- Sales records

- Exemptions such as veterans' benefits

This information is available to the public and can be obtained by an office visit, over the phone, or through online access. Note that fees may apply. Below are links to the websites of assessor offices for some of Ohio's major counties:

Note that the terms "auditor" and "assessor" are often used interchangeably in the context of property records.

Hire a Title Agency

In their duty to perform thorough title searches to ensure properties are free of encumbrances, title companies usually collect and maintain the most current, accurate, and comprehensive property records. These include deeds, mortgages, liens, and other public records that may affect property ownership. These records also include local government archives and historical records that are essential in mapping out a detailed ownership history.

In Ohio, the average cost of a title search is around $34 (assuming a standard two-page deed), according to the Ohio Recorders' Association. If the title search document exceeds two pages, there would be an additional $8.00 per page.

Contact the Ohio Secretary of State Office

This method would especially be helpful if the property in question is owned by business entities such as a corporation or an LLC. While it may not maintain as comprehensive databases as the county offices, the Ohio Secretary of State office has detailed records of all businesses operating in the state, including their agent and principal address. This information is available to the public and can be accessed by visiting the office in person, over the phone at (877) 767-6446, or through their website.

![]() Turn to a Commercial Service Provider

Turn to a Commercial Service Provider

Many online commercial service providers can help find the owners of properties in Ohio. These services seek to provide convenience and efficiency by compiling data from various sources and presenting it in an easy-to-read format. They also consolidate the data from all Ohio counties, saving you the time and the stress of visiting each county recorder's office.

PropertyChecker.com provides a vast, up-to-date, and comprehensive database of all properties in Ohio. The website offers multiple search options, including property address, parcel ID, owner's name, phone, or email. PropertyChecker.com can help you identify current and past owners of any property in Ohio and uncover the owner concealed by legal and business entities. In addition to ownership details, we help you find out essential property details, including:

- Up-to-date property owner information (name, phone, and mailing address)

- Purchase history: sale prices, dates, loan records

- Deeds

- Property details: size, number of rooms, renovations

- Up-to-date neighborhood information, such as crime rates, schools, demographics

- Property tax records

- Building permits and foreclosure records

You can also hire the services of legal professionals, especially for property owned by trusts or those with complicated ownership structures. You can also contact the previous owner of the property and local real estate brokerages/agents.

Property Ownership Laws in Ohio

Title 53 of the Ohio Revised Code (ORC), Real Property, is the key statute that governs property ownership in Ohio. Under ORC Chapter 5301, property records, such as deeds, mortgages, liens, etc., must be notarized to ensure the validity of property transactions and filed with the county recorder's office.

Ohio law recognizes several types of property ownership:

- Individual ownership

- Joint ownership (joint tenancy and tenancy in common)

- Legal entities (trust ownership, LLC ownership, and corporation ownership)

What Are the Different Types of Property Ownership in Ohio?

Contrary to what most people believe, property ownership in Ohio can't be oversimplified as fully acquiring a piece of real estate and registering it under your name. It's a collective term that includes how an individual or individuals within groups (a couple, family, joint owners, or a business entity) can exercise rights over Ohio real estate.

Property ownership in Ohio also includes the practical, legal, and financial benefits and implications of various structures or arrangements. As such, it's important to understand the full scope of the benefits you stand to gain from a certain property ownership structure or the liabilities that may come with it before you agree to have your name on the title.

The main property ownership structures can be broadly classified into three categories:

-

Sole Ownership: This is the most common type of property ownership in Ohio. A sole owner holds all rights to a property and can sell, transfer, mortgage, or gift it as they deem fit. However, Ohio law under Section 3105.171 requires a non-owner spouse in a legal marriage to sign any documents related to the sale, transfer, or encumbrance of property solely owned by the other spouse.

-

Co-Ownership: Two or more people own the same property in equal or unequal shares, each co-owner having rights and responsibilities proportional to their share. In Ohio, this can further be classified into joint tenancy, tenancy by the entirety, and tenancy in common.

-

Ownership by Legal Entities: This type of ownership is by corporations, limited liability companies (LLCs), or trusts. It affects how property is managed and transferred in Ohio.

Comprehensive Overview of Property Ownership Structures

Here are the main property ownership forms and structures you'll encounter in Ohio, as well as their benefits and implications.

| Ownership Structure | Description | Benefits | Implications |

|---|---|---|---|

| Sole Ownership | A single individual holds full rights to the property. | Complete control over property decisions and legacy. | Sole liability for debt and taxes associated with the property. |

| Joint Tenancy | Two or more persons hold equal shares with the right of survivorship. | Easy transfer of share upon death; no probate required. | If one owner sells their interest, joint tenancy is severed. |

| Tenants by Entirety | A joint tenancy specifically designed for married couples. | Protection from individual creditors and survivorship rights. | Property decisions have to be mutually agreed upon. |

| Community Property | Property acquired by both spouses during the marriage and is, therefore, equally owned by both. | Equal rights to use, manage, and dispose of property. | Upon divorce, the property is equally divided. |

| Tenancy in Common | Two or more owners can hold equal or unequal shares without survivorship rights. | Shares can be sold or inherited independently. | It may cause disputes over share management and transfer. |

| Condominium Ownership | Individuals own a unit within a complex and share ownership of common areas. | Ownership of personal living space with access to amenities. | Subject to homeowners' association rules and fees. |

| Cooperative Ownership | Residents collectively own the entire property. | Affords greater community control and lower purchase costs. | The sale of shares requires approval from other members. |

| Trust Ownership | Property held by a trust for its beneficiaries. | Provides tax benefits and protects assets from creditor claims. | The trust structure may complicate property transfer and management. |

| Life Estate | Ownership for the duration of an individual's life, after which the property passes to another party. | Right to use and benefit from the property during one's lifetime. | The sale or transfer of property interests requires the consent of the remainderman. |

Common Methods of Property Transfer in Ohio

Property transfer involves the preparation and signing of property deeds. These facilitate transfer by outlining the specifics of the transfer. They include any rights, privileges, or claims associated with the property.

The current owner (grantor) drafts a deed identifying the individual(s) receiving ownership rights (grantee). Upon agreement of the terms, both parties sign the property deed before a notary, which is subsequently filed with the county recorder's office. This process usually occurs during various property transfer cases, including:

- Sale

- Transfer due to a will or trust

- Gifts of property

- Transfers between family members

- Divorce settlements

- When adding or removing someone from the title

The most common types of deeds used in Ohio are:

-

Warranty Deeds: This deed protects the buyers from future claims to the title and assures them (the seller) that the property has no outstanding mortgages or liens.

-

Grant/Special Warranty Deed: This deed passes ownership from the seller to the buyer with two key assurances: The seller has not previously transferred the property to other parties, and the property is not subject to encumbrances or liens not disclosed to the grantee.

-

Quitclaim Deeds: Commonly used in non-sale situations whereby the grantor surrenders any rights to the property without providing guarantees or warranties of ownership. An example of a non-sale situation is the transfer of property rights between family members.

-

Deed of Trust: This is an alternative to a mortgage to secure a loan. An impartial trustee holds the property title until the loan is repaid, at which point the trustee releases the deed to the borrower.

Other types of deeds include bargains and sales and mortgage deeds. The former is a lot similar to a quitclaim deed but is used for bulk sales. The latter is similar to the deed of trust but creates a direct line between the borrower and the lender.

Ohio Homeowner Lookup

- Owner(s)

- Deed Records

- Loans & Liens

- Values

- Taxes

- Building Permits

- Purchase History

- Property Details

- And More!